Oracle

What is a Price Oracle ? 🔎

In lending protocols, accurately determining the value of an asset is essential.

A price oracle is a tool that retrieves and provides the current price of an asset, sourcing the data either directly from the blockchain (on-chain) or from external systems (off-chain).

Ensuring Accurate Pricing with Off-Chain Solutions 🎯

On-chain oracles can sometimes face challenges like price inconsistencies.

To provide robust price reporting, our protocol uses an off-chain oracle, Pyth Oracle.

Pyth provides advanced security by aggregating data from multiple trusted sources, such as exchanges and financial institutions, delivering accurate and reliable pricing information.

Understanding Push Oracles and Pull Oracles 💡

Push Oracle : Continuously sends price updates to the protocol at regular intervals,

regardless of whether the data is immediately needed.Pull Oracle : Provides price updates only when explicitly requested by the protocol.

What benefits does a pull oracle offer ?

What Benefits does a Pull Oracle Offer ? ✅

To ensure security and reliability, Colend uses a pull oracle model with Pyth Oracle.

Here’s why this approach is advantageous :

Data Integrity : With a pull model, the protocol requests price updates only when needed, ensuring that all decisions are based on accurate and current information, avoiding the risk

of outdated data.Increased Security : Push oracles send data continuously to the protocol, which can lead

to unnecessary exposure. In contrast, pull oracles request data only when needed, ensuring

a more controlled and secure approach to price updates.Control Over Data Retrieval : The pull model allows the protocol to control when and how often it queries the oracle, reducing unnecessary network load.

Enhanced Validation : Pulling data on-demand allows immediate validation and comparison with other sources, enhancing the accuracy and reliability of the price data used in the protocol.

By using Pyth Oracle with a pull approach, our protocol benefits from enhanced security, reliable data aggregation, and robust mechanisms to prevent price manipulation, ensuring a more secure and trustworthy lending platform.

Integration of Complementary Oracles 🦾

To further enhance the flexibility and responsiveness of our protocol, we are also integrating complementary oracles such as Switchboard.

Switchboard is another pull oracle that decentralizes the process of adding price feeds

by incorporating price fees in a decentralized manner. This integration offers more adaptability

and quicker listing of new assets, thereby providing additional robustness and responsiveness

to market changes.

The Fallback Oracle System ⚙️

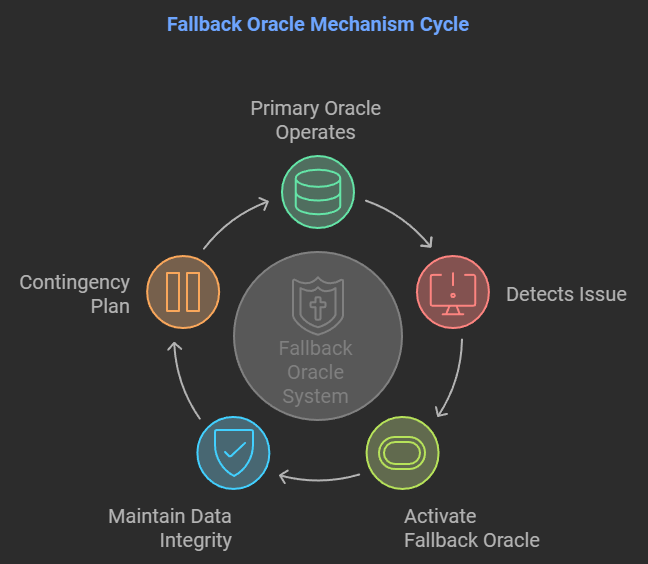

In addition to integrating complementary oracles, we employ a fallback oracle mechanism.

This system is designed to automatically activate if our primary oracle encounters issues,

such as downtime or erroneous price feeds.

When the primary oracle fails to deliver accurate data, the fallback oracle takes over, providing

a reliable price feed without interruption.

This design is crucial because it ensures that our protocol remains robust and continues to operate smoothly. In the unlikely event that both oracles encounter issues, we have a contingency plan in place: the ability to pause the protocol. This feature allows us to protect users and their assets until we can resolve any data discrepancies.

By not relying solely on a single data provider, we build a more resilient price feed system that enhances the security of our lending protocol named "Inception Oracle" which will allow to secure assets with 3 fallback oracles. With this strategy, we not only maintain data integrity but also foster trust and confidence among our users, knowing that their transactions are backed by reliable price information.